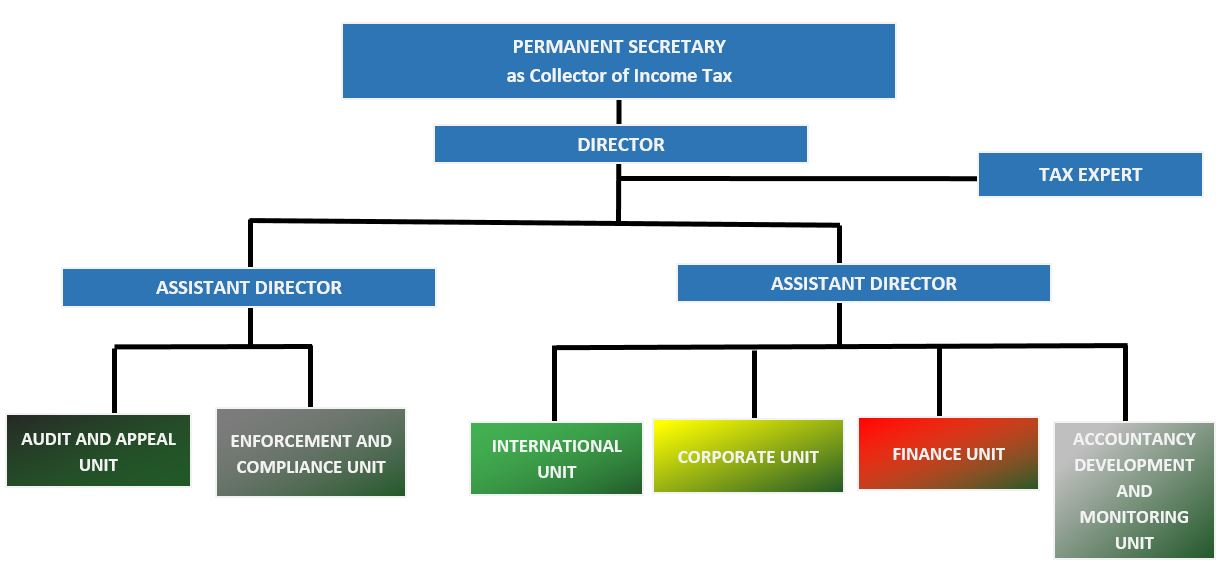

Organisational Structure

There are 6 units under the Revenue Division, namely:

- Audit and Assessment Unit

- Corporate and Policy Unit

- Finance Unit

- Enforcement Unit

- International Unit

- Accountancy Unit

AUDIT AND ASSESSMENT UNIT

This Unit is responsible for the assessment process of Income Tax, Stamp Duty and Withholding Tax.

CORPORATE AND POLICY UNIT

This Unit is responsible for:

- the formulation of tax policies and tax laws;

- the registration of companies;

- the administration of human resource and training;

- the collection of data for statistics and maintaining website.

FINANCE UNIT

This Unit is responsible for the collection and repayment of Income Tax, Stamp Duty and Witholding Tax.

ENFORCEMENT UNIT

This Unit is created to enhance enforcement of tax collection and to promote voluntary compliance among taxpayers in the filing and payment of tax.

INTERNATIONAL UNIT

This Unit is responsible for:

- preparing, conducting and reviewing negotiations on Avoidance of Double Taxation Agreement (DTA), Bilateral Investment Treaties (BIT) and Tax Information Exchange Agreement (TIEA);

- establishing internationals relations (ASEAN, APEC, OECD, ATAIC, IMF, CATA);

- processing and issuing certificate of residence;

- processing application for tax relief;

- processing request for exchange of tax information.

ACCOUNTANCY UNIT

This Unit is responsible to process applications for the Public Accountant's Licence in Brunei Darussalam.