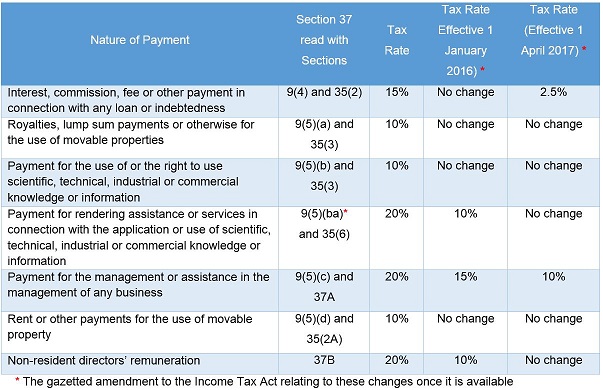

Withholding of Tax - Tax Rates

TAX RATES

Any resident company or permanent establishment who makes payment of a specified nature to a non-resident companies (including non-resident directors), a certain percentage of the payment must be withheld and paid to the Collector of Income Tax (CIT). The percentage amount withheld is withholding of tax.

Tax must be withheld from payments made to a non-resident person at the following rates:

Further guidelines on Withholding of Tax can be

obtained in the Public Ruling.