Witholding Tax

What is witholding tax?

Withholding tax is a percentage of payment withheld by a local company on payment made of a specific nature (as per the table below) to a non-resident that is withheld and paid to the Collector of Income Tax.

Who is a non-resident?

A non-resident is a company or body of persons whereby the control and management of whose business is not exercised in Brunei Darussalam.

What are the witholding tax rates?

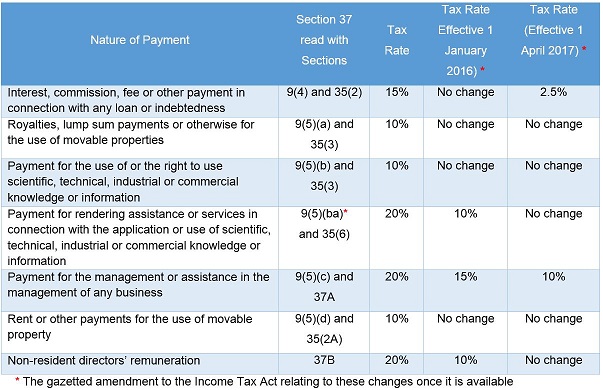

The tax rate varies, depending on the nature of payment made to the non-resident:

When is the due date for the filing and payment of withholding tax due?

Payment due date is within 14 days after payment shall be deemed to have been paid although it is not actually paid over to the other person but is “reinvested, accumulated, capitalized, carried to any reserve or credited to any account however designated or otherwise dealt with on behalf of the non-resident person”.

Will there be any penalty imposed for late payment or filing of withholding tax?

By the 15th day following the date of payment, sum equal to 5% of such amount of tax shall be payable; and within 30 days after the 15th day following the date of payment, an additional penalty of 1% shall be payable for each completed month that the tax remains unpaid, up to a maximum of 15%.

What are the necessary documents required for Witholding Tax refund?

Complete documentation is required for the refund review:

a) Certificate of Resident for relevant Year of Assessment.

b) Filing of Income Tax Return for relevant Year of Assessment.

c) Copy of Invoice

d) Copy of Contract/Agreement

e) Proof of payment

f) If refund is requested by local/branch company, authorization letter from non-resident is required.

g) Any other supporting document (i.e Breakdown or work done)