Income Tax

INTRODUCTION OF A NEW FEATURE TO ONE COMMON PORTAL (OCP) – UPDATES TO THE PETROLEUM TAX FORM

Please click here (ENGLISH) and here (BAHASA MELAYU) for more information

TAX RATES

Income Tax in Brunei Darussalam is governed by the Income Tax Act (Chapter 35) and Income Tax (Petroleum) Act (Chapter 119), Laws of Brunei.

Under Section 8(1) of this Act, income accrued in, derived from, or received in Brunei Darussalam by any corporations, registered locally or elsewhere was taxed at the rate of 30%.

The provisions of the Act shall not have effect in respect of incomes of any other persons or bodies of person.

Effective from 1 January 2008, the corporate tax rate has been revised as follows:

Tax threshold has been introduced under section 35(4) of the Income Tax Act.

Profit of companies engaged in the exploration and production of oil and gas, will be taxed at the rate of 55%.

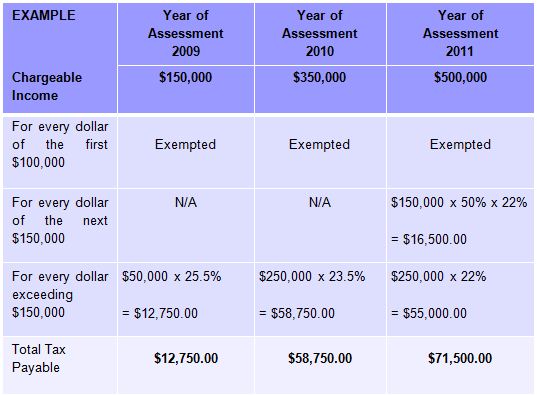

NEWLY INCORPORATED COMPANIES

Under section 35(5) of Income Tax Act (Cap 35), exemption will be granted to a newly incorporated company in Brunei Darussalam for the first $100,000 of the chargeable income during the first 3 consecutive Years of Assessment falling within or after Year of Assessment 2008. Tax threshold is also granted where for the next $150,000 of chargeable income (if any), tax shall be charged at 50% of the applicable tax rate.

Note: First 3 years of assessment in relation to a newly incorporated company means the year of assessment relating to the basis period during which the company is incorporated or registered in Brunei Darussalam and the 2 consecutive years of assessment immediately following that year of assessment.

TAX THRESHOLD

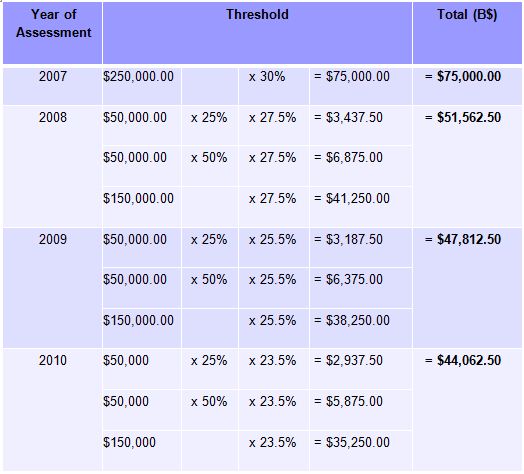

EXISTING COMPANIES

As a measure to reduce the tax liabilities of small and medium companies, the tax threshold introduced since 2008 under section 35(4) of the Income Tax Act shall be computed as follows:

(i) For the first $50,000 of chargeable income, tax shall be charged at 25% of the applicable tax rate;

(ii) For the next $50,000 of chargeable income (i.e. $50,001 to $100,000), tax shall be charged at only 50% of the applicable tax rate;

(iii) The remaining balance of the chargeable income (Total chargeable income - $100,000), shall be taxed at the applicable tax rate.

Example: Chargeable Income (CI) = $250,000

Effective from 1 January 2010, the threshold of the chargeable income has been increased, as stipulated in the

Income Tax Act (Amendment)(No.2) Order, 2010.

(Note: Section 35(4) of the Income Tax Act (Amendment) Order, 2009 is only applicable for the Years of Assessment 2008, 2009 and 2010.)

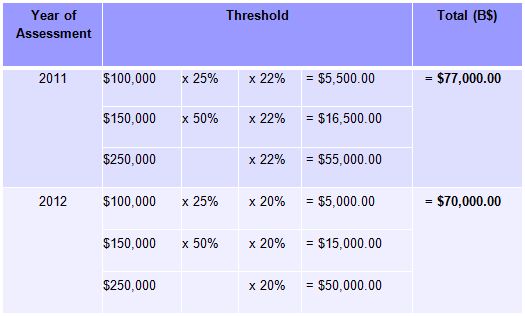

The tax threshold for the Year of Assessment 2011 and subsequent Years of Assessment shall be computed as follows:

(i) For the first $100,000 of chargeable income, tax shall be charged at 25% of the applicable tax rate;

(ii) For the next $150,000 of chargeable income (i.e. $100,001 to $150,000), tax shall be charged at only 50% of the applicable tax rate;

(iii) The remaining balance of the chargeable income shall be taxed at the applicable tax rate.

Example: Chargeable Income (CI) = $500,000

Pursuant to section 35(6A) of the Income Tax Act (Amendment) (No.2) Order, 2010, the tax rate of 22% shall not apply to any part of the chargeable income of any company which is attributable to the income derived by the company before 1 January 2010.

(Note: Section 35(6A) of the Income Tax Act (Amendment) Order, 2009 is only applicable for income accruing in or derived from Brunei Darussalam from 1 January 2009 until 31 December 2009.)

TAX ON EXPORTS

A flat tax rate of 1% has been introduced to encourage export activities in respect of approved types of export. As shown in Appendix 1.

Under this treatment, total turnover of the exporter is treated as exports, if the local sales do not exceed 20% of the total turnover.

ADMINISTRATION/GENERAL

REGISTRATION OF LOCAL USER ACCOUNT IN ONE COMMON PORTAL (OCP)

Users will first need to create an account in OCP, once completed, they will then be able to access OCP e-Services. For further guidance on registration in OCP, please refer to Resources & Guide> Getting Started in the OCP website.

FILING OF ESTIMATED CHARGEABLE INCOME

Under section 52A of Income Tax Act , a company is required to submit its estimated chargeable income to the Collector of Income Tax within 3 months after the end of the accounting period relating to that year of assessment.

FILING OF INCOME TAX RETURN

A company is required to file its annual Income Tax Return with the Collector of Income Tax by 30 June each year. Income Tax Returns is a company’s declaration on their income or profit for a period of 12 months. Any changes to the basis period must be notified to the Revenue Division via email at revenue@mofe.gov.bn, accompanied by a copy of the Company Circular indicating the change in the financial year-end.

The Form must be submitted together with a certified copy of the audited Financial Statements, Income Tax Computation and supporting schedules.

Failure to file returns is an offence against the Income Tax Act and upon conviction, will be liable to a fine of B$10,000 and in default payment to imprisonment for 12 months.

REQUIREMENT OF KEEPING OF BOOKS

Each company is required to keep adequate records of business transactions for the 7-year period to enable the Collector of Income Tax to determine the correct amount of tax liable to the company. The required records include complete and accurate records of opening and closing stocks, purchases, sales, receipts, invoices, bills of lading, and all other documents and books of account pertaining to business.

CHANGE OF ADDRESS

A company must notify the Registrar of Companies and Business Name (ROCBN) of its new registered office address. Once the changes are approved by ROCBN, the change of address will be automatically updated in OCP.

ASSESSMENT

The period of assessment is on a preceding year basis where a calendar year ending 31st December is adopted as the basis period. Any changes to the basis period must be notified to the Revenue Division via email at revenue@mofe.gov.bn, accompanied by a copy of the Company Circular indicating the change in the financial year-end.Tax shall be payable to the office of Collector of Income Tax within 30 days after the service of the Notice of Assessment eventhough the company has made an objection to the assessment.

TYPES OF INCOME

Among the types of income which are subjected to tax are:

i. Gains or profits from any trade, business or vocation;

ii. Gains or profits from any employment;

iii. the net value of land and improvements;

iv. dividends, interest, or discounts;

v. any pension, charge or annuity;

vi. rents, royalties, premiumsany other profits arising from property.

Detailed description of which can be found at

Part III of the Income Tax Act.

DIVIDEND INCOME

Dividends accruing in, derived from, or received in Brunei Darussalam by a corporation are included in taxable income, apart from dividends received from a corporation taxable in Brunei which are excluded;

Dividends received in Brunei Darussalam from the United Kingdom or Commonwealth countries are grossed up in the tax computation and credit is claimed against the Brunei tax liability for tax suffered either under the double tax treaty with the United Kingdom or provision for Commonwealth tax relief.

ALLOWABLE DEDUCTIONS

All expenses wholly or exclusively incurred in the production of taxable income are allowable as deductions for tax expenses.

These deductions include:

i. Interest on borrowed money used in acquiring income;

ii. Rent on land and buildings used in trade or business;

iii. Costs of repair or premises, plant and machinery;

iv. Bad debts and specific doubtful debts, with any subsequent recovery being treated as income when received;

v. Employers’ contributions to approved pensions or provident funds; eg Tabung Amanah Pekerja (TAP) or Supplement Contributory Pension Fund (SCP)

vi. Zakat, fitrah or any religious dues, payment of which is made under any written law.

DISALLOWABLE DEDUCTIONS

Expenses not allowed as deductions for tax purposes include:

i. Expenses not wholly or exclusively incurred in acquiring income;

ii. Domestic private expenses;

iii. Any capital withdrawal or any sum used as capital;

iv. Any capital used in improvements apart from replanting or plantations;

v. Any sum recoverable under an insurance or indemnity contract;

vi. Rent or repair expenses not incurred in the earning of income;

vii. Any income tax paid in Brunei or in other countries;

viii. Payments to any unapproved pension or provident funds;

ix. Donations are not allowable but claimable if they are made to approve institutions.

MOTOR VEHICLES

CAPPING ON DEDUCTIBLE EXPENSES AND CAPITAL ALLOWANCE WITH RESPECT TO MOTOR VEHICLES

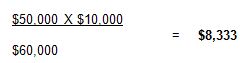

With effect from 1stJanuary 2008, qualifying expenditure on each motor vehicle, which is constructed or adapted for the carriage of not more than 7 passengers (exclusive of the driver), and the weight of the motor vehicles does not exceed 3,000 kilograms, bought on or after 1stJanuary 2008, shall be restricted to a maximum limit of $50,000.00 [Section 16(4) and 16(5)].

Section 11(1A) of Income Tax Act also restricts deduction on expenses incurred on motor vehicles that costs more than $50,000.00. The amount of expenses deductible for tax purposes shall be limited to the proportion that $50,000.00 bears to the actual costs of the motor vehicles.

For example, a car costs $60,000.00 and during the year incurs maintenance expenses of $10,000.00, including fuel and repair, the deduction allowable on the expenses incurred for that year of assessment shall be computed as follows:

INDUSTRIAL BUILDINGS AND STRUCTURES

INCLUSION OF HOTEL-KEEPING

In line with the Government’s effort to promote tourism sector in Brunei Darussalam, claims for capital allowance on Industrial Building or Structure under section 15(1) of the Income Tax Act (Chapter 35) has now been expanded to include capital expenditure on the construction of a building or structure which is occupied for the purposes of a trade of hotel-keeping.

Therefore for any such building or structure which is in operation prior to 1stJanuary 2008, shall only be eligible to claim Annual Allowance at the rate of 4% per annum in accordance with section 15(3) of the Income Tax Act (Cap 35). Claims for Initial Allowance for such building or structure will only be available to the Capital Expenditure incurred on buildings or structured completed on or after 1stJanuary 2008.

CAPITAL ALLOWANCES

Depreciation is not an allowable expense and is replaced by capital allowances for qualifying capital expenditure. The rates of Capital Allowance can be found in the Subsidiary Legislation of the Income Tax Act.

(I) INDUSTRIAL BUILDINGS

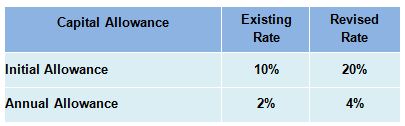

An initial allowance of 10% of the cost given in the year of expenditure, and an allowance of 2% of the qualifying expenditure is provided on a straight line basis until the total expenditure was written off.

However, with effect from 1 January 2008, the rate for claims on Capital Allowances, i.e. the Initial and Annual Allowances of the qualifying expenditure under section 13(1) and 13(2)(a) of the Income Tax Act, has been revised and increased as follows:

(II) PLANT AND MACHINERY

An initial allowance of 20% of the cost is given in the year of expenditure together with annual allowances calculated on the reducing value of the assets. The rates prescribed by the Collector of Income Tax range from 3% to 25% depending on the nature of the asset.

With effect from 1 January 2009, a company has an option to claim annual allowance under section 16B(1) of Income Tax Act for a period of 3 years at the rate of 33⅓% in respect of the capital expenditure incurred.

DISPOSAL OF INDUSTRIAL BUILDING, PLANT OR MACHINERY

Balancing allowances or charges are made on disposal of the industrial building machinery or plant. These adjustments cover the shortfall or excess of the tax written down value as compared to the sale proceeds.

UNABSORBED CAPITAL ALLOWANCE

Unabsorbed capital allowances can be carried forward indefinitely but must be set off against income from the same trade.

TAX CREDITS

(I) LOCAL EMPLOYMENT

When a company employs a local individual to work in its company, the company is entited to claim tax credit at 50% if the amount of salary paid to such new employee for a maximum of 3 years of employment.

(II) ADDITIONAL CONTRIBUTION MADE TO TAP (IN EXCESS OF CONTRIBUTION MADE DURING THE PREVIOUS YEAR)

Tax credit is admissible over and above the deduction and further deduction on contribution to TAP at the rate of 10%.

(III) TRAINING

When a company incurs expenditure on training of its employees, tax credit of 100% of the gross salary paid during the training period is allowed against the tax payable.

(IV) FRESH INVESTMENT IN PLANT AND MACHINERY FOR BALANCING, MODERNISATION AND REPLACEMENT

When a company invests in new plant and machinery for balancing, modernisation and replacement of the business, it is entitled to 15% of the amount invested which is allowed against the tax payable.

LIMIT ON TAX CREDITS

The total amount of tax credits cannot exceed 50% of total tax payable in one year, excluding credit for foreign tax paid.

TAX RELIEF

COMMONWEALTH INCOME TAX

Relief may be obtained on income arising from Commonwealth countries that provide reciprocal relief. The maximum relief cannot exceed half the Brunei Darussalam rate and it applies to both resident and non-resident companies.

INVESTMENT INCENTIVES ORDER, 2001

This Order was introduced to encourage the establishment and development of industrial and other economic enterprises in Brunei Darussalam and also to attract local and foreign investors to invest in Brunei Darussalam.

OBJECTION

If any person disputes the assessment, he may apply to the Collector, by notice of objection in writing, to review the assessment rendered upon him by stating precisely the grounds of his objections within 30 days from the date of the service of Notice of Assessment.